how long does the irs collect back taxes

There is an IRS statute of limitations on collecting taxes. Learn more about the IRS Statute of Limitations here.

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date.

. This time restriction is most commonly known as the statute of limitations. The IRS 10 year statute of limitations starts on the day that your. But the agency cant chase you forever.

In certain situations the. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. Secure ways to pay your taxes.

As a general rule there is a ten year statute of limitations on IRS collections. How far back can the IRS collect unpaid taxes. After this 10-year period or.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were. The IRS releases your lien within 30 days after you have paid your tax debt. However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes.

This 10-year limit is. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. As a general rule there is a ten year statute of limitations on IRS collections.

Does the IRS forgive tax debt after 10 years. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Paying your tax debt in full is the best way to get rid of a federal tax lien. A tax assessment determines how much you owe.

After that the debt is wiped clean from its books and the IRS writes it off. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. The IRS has a 10-year statute of limitations during which they.

In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions. Failing to pay your taxes may lead to IRS collection activities. The collection statute expiration ends the.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. This is known as the statute of. GET PEACE OF MIND.

After that the debt is wiped clean from its books and the IRS. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. If you did not file.

How Long Does The IRS Have To Collect Back Taxes. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. This 10-year limit is.

The IRS generally has 10 years from the date of assessment to collect on a balance due. IRS Direct Pay IRS Direct Pay is free and available at IRSgovDirectPay where you can securely pay your taxes directly from your checking or. In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions.

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

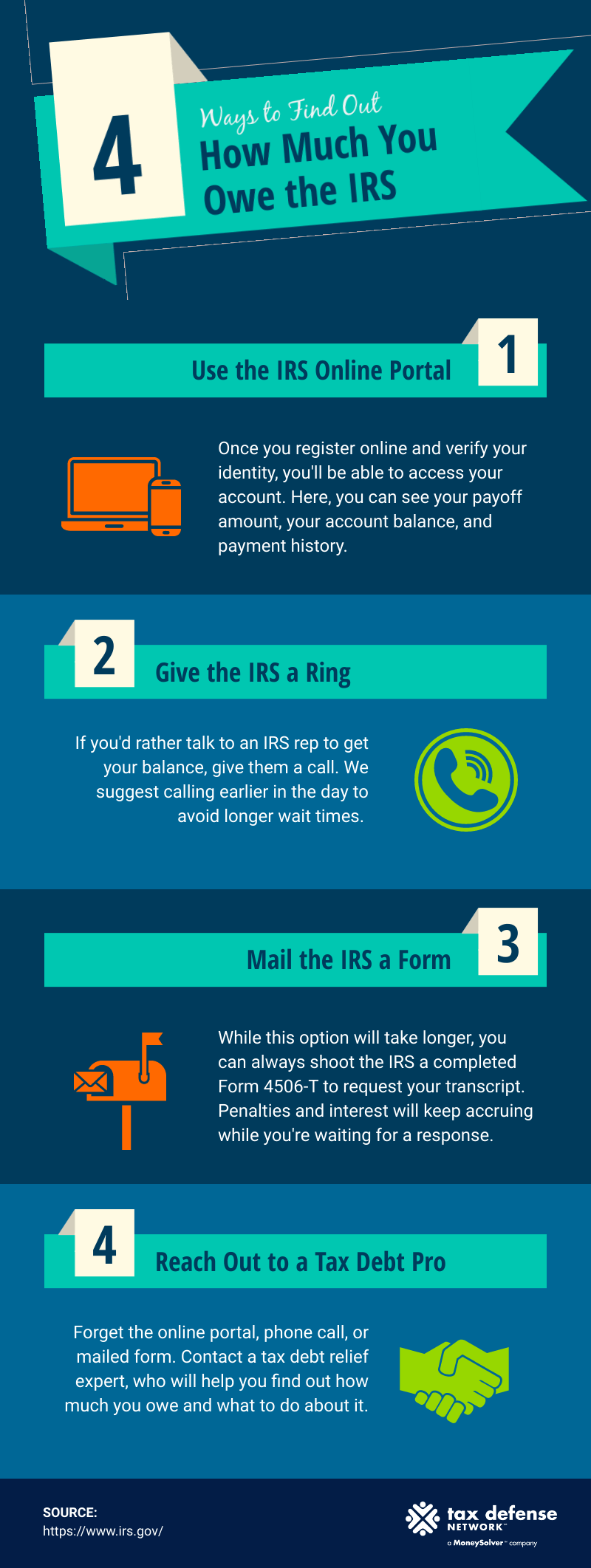

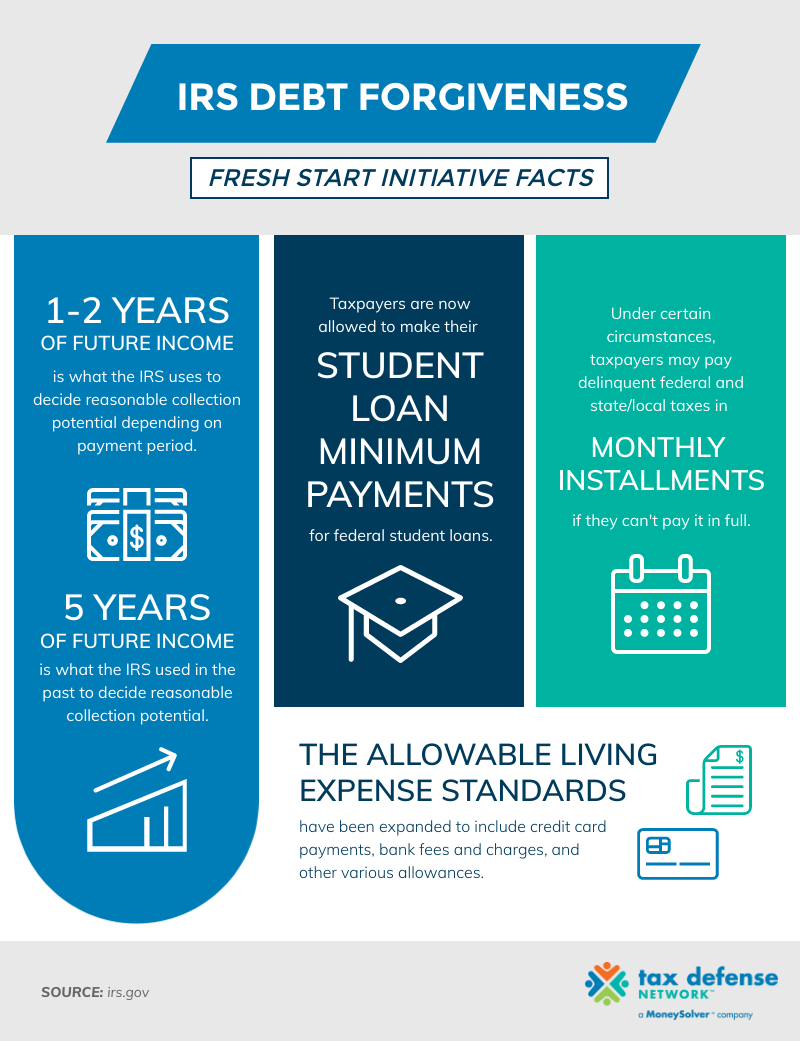

What Is The Irs Debt Forgiveness Program Tax Defense Network

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

Irs Bank Levies Can Take Your Money Debt Com

Does The Irs Forgive Tax Debt After 10 Years

Tax Levy Understanding The Tax Levy A 15 Minute Guide

/cloudfront-us-east-1.images.arcpublishing.com/gray/PFK6RYMGXRKTPEUPPV4WXJQDE4.jpg)

Irs Hiring Private Debt Collectors To Collect Back Taxes

How Does The Irs Collect Back Taxes Youtube

How Far Back Can The Irs Go For Unfiled Taxes Abajian Law

How Far Back Can The Irs Collect Unfiled Taxes

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

How Far Has The State Gone Back For Failure To File Taxes Priortax

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

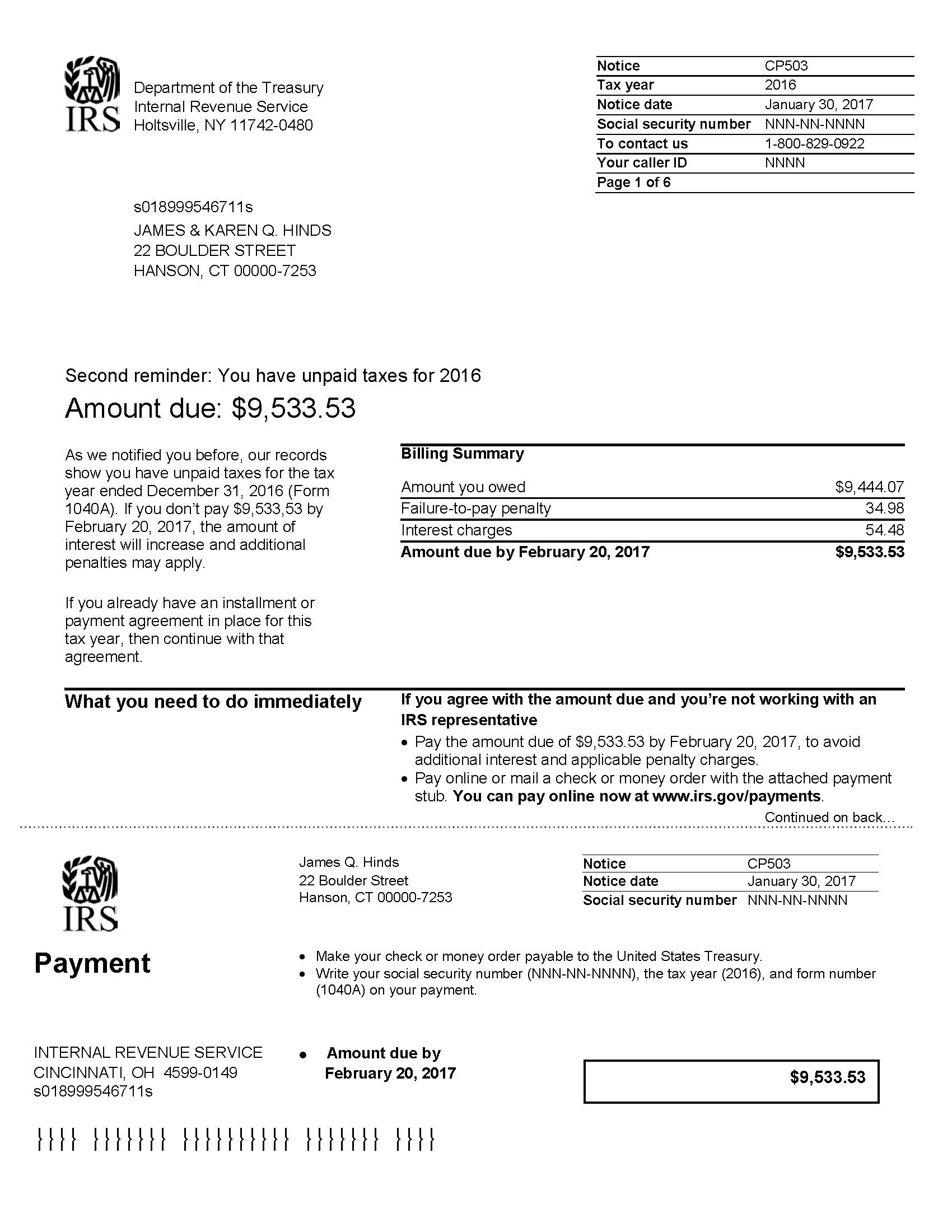

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

Tax Debt Here S How To Handle Outstanding Federal Obligations

Everything You Need To Know About Irs Tax Forgiveness Programs